What if you had the freedom to fully pursue your God-given mission without regard for fundraising? What would your church look like if ministry funding wasn’t a concern?

Long-term sustainable funding is not something unattainable, and it’s not something that requires you to continually be in a season of fundraising through capital campaigns. There is a better solution – one that doesn’t tire your congregation with ongoing funding campaigns.

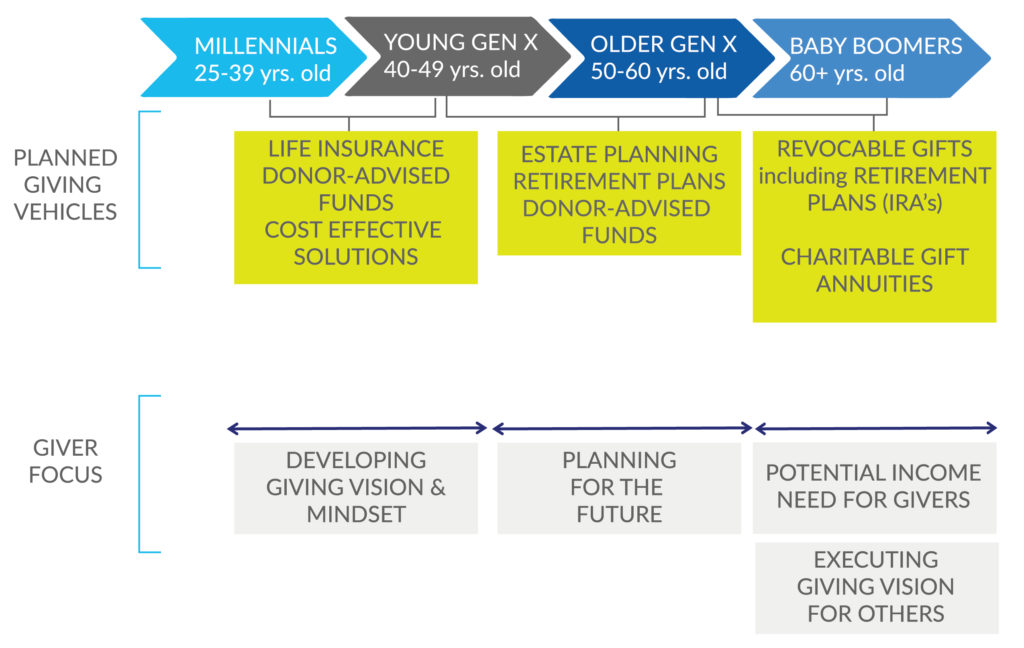

The solution is a major gifts ministry! Now, before you click away and tune out the rest of this blog because of the mention of “major” gifts, which also translates to “planned giving” or “never going to see the gift because it’s a bequest,” stop and take a few moments to read on. Major gifts are not for the dead or dying but actually work for every, yes every generation!

Here are 3 ways a Major Gifts Ministry is better than a fundraising campaign–

1. Large Gifts from All Age Groups

Not small-dollar commitments over a short period

$68 Trillion is being passed down from Baby Boomers to the next generation. These inherited funds will need a place to be distributed, and several asset-based options are growing in popularity with younger generations. Millennials are leading the group with Donor-Advised Funds. According to Vanguard Charitable, “Our millennial donors give at a higher clip with DAFs and are more likely to follow up with nonprofits to monitor the impact of their giving, suggesting that they will have a major impact on the future philanthropic landscape.”

Review the generational giving chart.

2. Payments to Ministry Today and for Longer Timeframes

You’re not waiting on an end-of-life strategy

Most annual gifts come from current income. Major gifts, however, can come from one’s accumulated assets. Over 90% of a person’s wealth is not found in cash but assets. And these assets don’t require a will or bequest; they can be used today to fund ministry.

Here are a few charitable gift options that produce income and pay immediate stipends to the church –

- Retirement Plans, IRAs

- Life Insurance Policies

- Real Estate

- Charitable Gift Annuity

- Charitable Remainder Trust

- Charitable Lead Trust

- Donor-Advised Fund

- Pooled Income Fund

3. Tax-Savings for the Giver = More Contributions to the Church and Less to Government

Wouldn’t it be great to help your givers not only save on taxes but give more significant amounts because the government isn’t taking a portion? Of course, it would! In addition to charitable deductions, most major gift arrangements provide the opportunity to reduce or eliminate tax obligations.

Click here to see a chart of major gifts that benefit the church and the giver.

Let’s get off the hamster wheel of fundraising and instead faith-raise through generosity discipleship. Now don’t get us wrong, capital campaigns are not always a bad thing. And, capital improvement projects are something we will never be able to get away from completely. We simply suggest that your capital strategies could come from funds through a Major Gifts/Planned Giving Ministry. We would call that a win-win for the giver and the church!

But, don’t go at this alone – we’re here to help!

- Register today for the Developing Major Gifts Event on November 18 at Peachtree Church, GA. Get 50% off – use coupon code: PG50

- Get a free customized Gift Planning report; click here to fill out the request form.