Non-Cash Giving – Legacy Impact Ministry

WHAT IS NON-CASH GIVING?

Non-cash giving is also referred to as gift planning or legacy giving. It enables a giver to make larger gifts to your church today and for the future.

Non-cash giving is not just for older givers, but should be introduced to givers at every stage of life as an overall generosity strategy.

Download more information on starting a Legacy Impact Ministry.

LESS TO TAXES

LESS TO TAXES

Givers typically receive a tax deduction for the fair-market value of their gift.

MORE TO SAVINGS

Because givers receive the full tax deduction, they’ll see significant savings on their income tax returns.

INCREASED GENEROSITY

INCREASED GENEROSITY

The capital gains taxes givers save from giving directly means more goes to support your ministry.

TYPICAL GIVER

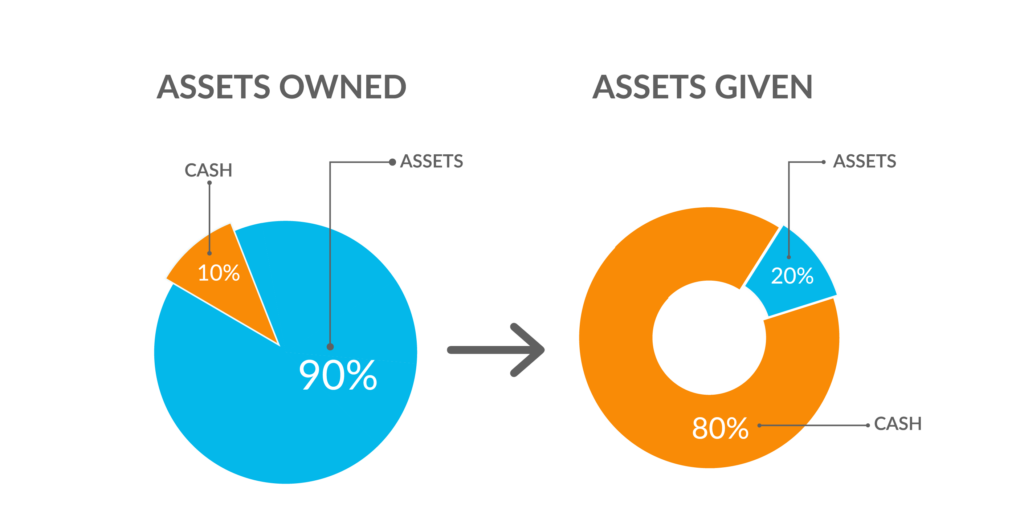

IRS statistics show that most people give from cash, even though their wealth is held in non-cash assets.

Let’s schedule time to discuss your church’s needs. Click to contact us or use our Live Chat feature.