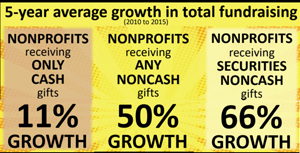

Throughout the history of the American Church, congregations have been disproportionately reliant on cash donations to support their annual budgets. From pledge cards to capital campaigns – cash has been considered “king.” But is it really? Our friend Dr. Russell James is a tax attorney who has served as the President of a Christian college and now chairs the financial studies department at Texas Tech University. His research clearly shows that those who teach their givers how to give from non-cash assets have exponential growth in funding as compared to Churches and Not for Profit Organizations that only solicit donations from cash. His research cites that at least 97% of our nation’s wealth is held in non-cash assets versus the 3% held in checking accounts. Which begs the question, “Is cash really king?”

In early November, we led a series of seminars that helped givers directly understand why they should give and how they can give tax-smart gifts from their balance sheet, not just their W-2 income. Of the 52 giving households that attended the seminars, over half requested more information and an individual follow-up consultation. Here are a few examples of what transpired from these seminars!

We had the opportunity to meet with a 73-year-old attorney that was looking for a tax deduction and income for life. After consulting with him, he gave the Church a $100,000 life income gift. This gift provided the tax deduction he sought and ultimately saved him $35,000 in taxes. In addition to the tax deduction, the giver will receive a stream of income for the remainder of his life! The benefit to the Church is that they will receive 100% of the gift when the couple goes to meet Jesus in heaven.

Our consultation involved a 75-year-old widow with no heirs looking to increase her retirement income. The giver has a small savings account and a house valued at $400,000 with a mortgage balance of $30,000. Based upon her financial goals, she sold the house to the Church for $200,000, which was converted into a Charitable Gift Annuity (CGA). The CGA produces the lifetime income she needs in retirement. She received an ordinary tax deduction in the amount of the home’s fair market value that can be carried forward for up to five years. In addition to the purchase price, the Church agreed to retire the mortgage and provide a Life Estate agreement, meaning the giver can remain in the house rent-free for the rest of her life. Upon death, the Church will retain the remaining balance of the Charitable Gift Annuity and then sell the house – free of capital gains tax.

We spoke with a single retired law enforcement officer who has adequate income from her pension and other assets. Several years ago, she purchased a lot for $85,000 to build a home; however, her plans to build on the lot changed. The lot is currently valued at $185,000, meaning she would face substantial capital gains taxes should she choose to sell the property. To resolve this tax problem, she gave the property as an outright gift to the Church, avoiding all capital gains tax. The Church, in turn, will sell the lot and use the cash for ministry. The giver received an ordinary income tax deduction at the time of the gift for the fair market value of the lot, which she can carry forward for up to five years. Not only was she relieved for the tax savings, but she found great joy in making a transformational gift.

We were able to partner with this Church to disciple 52 givers and conduct 29 follow-up conversations. The three end-of-year gifts are just the tip of the iceberg, as more gifts will be facilitated in the coming year. There are three common questions you may be asking yourself that we’d like to address.

Some churches may have the experience and expertise to facilitate complex gifts from non-cash assets in a giver-centric manner. However, we have found that even some of the largest churches in America struggle to offer more than Wills and Trusts seminars or the capacity to receive gifts of appreciated stock. Most churches could benefit from having a team of specialists that can bring focused attention to this opportunity.

The average 60-year-old in America has $824,000 in non-cash assets, which is more than $1.6 million per couple. We cite this data to simply point out that your Church is not terminally unique. Every Church has givers who are hard-wired to be generous. They simply don’t know how to give because no options are being provided to them beyond giving cash.

I’m glad you asked! We would be happy to spend 30 minutes evaluating your data and answering any questions you may have. All you need to do is fill out the form below and one of our Generosity Advisors will contact you to schedule a time.

Fully funding your ministry budget in 2023 and beyond is a reality that we think every Church should have the opportunity to realize. When we financially disciple our givers to consider their balance sheet and not just their bank statement, we provide givers with the ability to leave a lasting legacy – one that benefits both the giver and the Church today! Let’s make 2023 the year your Church achieves limitless funding opportunities that exponentially grow the cause of Christ. Let’s schedule a time to talk today!